What is this all about??

If Newberg voters choose to join TVF&R, we will be paying TVF&R separately on our property tax bills. The issue is that the City of Newberg can continue to collect what they do now, even though they no longer pay for Fire/EMS services!

How much could this cost me?

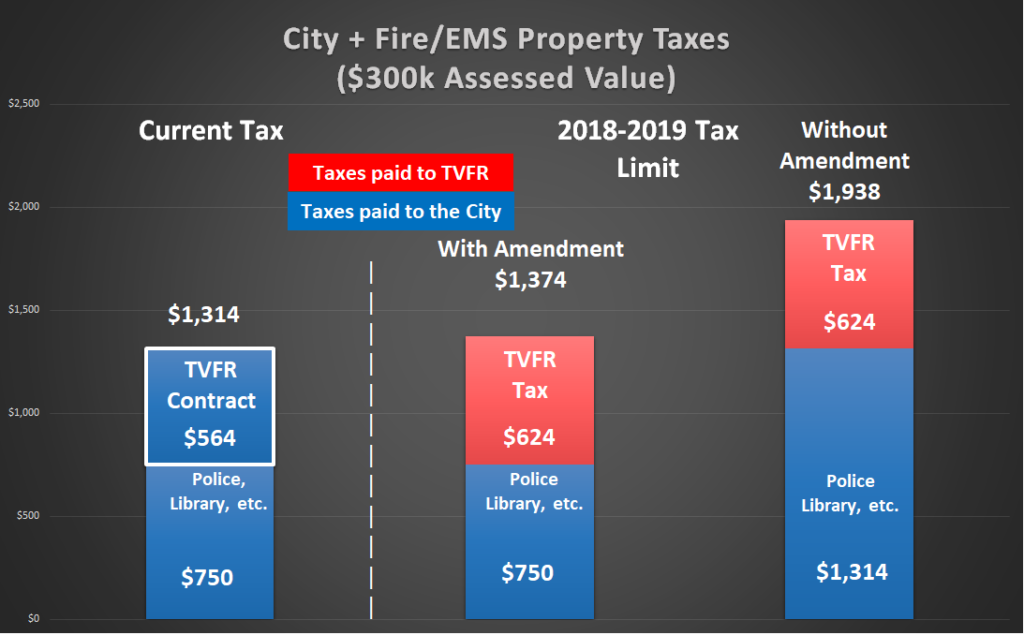

If your property has a $300k Assessed Value, you paid $1,314 to Newberg in Property taxes for 2017-2018. Newberg spent $564 of that for services from TVF&R. The first bar above shows this.

If Newberg joins TVF&R, the City of Newberg will no longer pay ANYTHING to TVF&R. If 36-191 (Newberg Charter Amendment) passes, the City will be limited to collecting $750 from you. You’ll also pay TVF&R $624 for their services, for a total of $1,374. This would result in a $60 increase. The second bar above shows this.

If Newberg joins TVF&R and 36-191 does not pass, Newberg could continue to charge you $1,314 and you’d pay TVF&R $624, for a total of $1,938! The third bar above shows this.

If 36-191 (Newberg Charter Amendment) fails, you could be paying $564 more to the City of Newberg! And it could INCREASE in the following years!

But I heard that Newberg WASN’T going to collect the additional tax!

TVF&R and the City Manager have both made this claim. There are two very important qualifiers left out. The first is that they won’t collect the additional tax IF 36-191 PASSES! That’s merely a statement that they’d follow the law!

The second qualifier is that, even if 36-191 passes, the City can increase the tax by 3% each year. It could get the full amount back in 20 years.

3% a year increases? I thought that the Charter Amendment was to stop increases!

That was the intent when citizens proposed this to the City Council. The City Council put the matter on the ballot adding the provision that the property tax could increase by 3% each year.

How can Newberg operate effectively if its property tax revenue is reduced by over 40%?

Because joining TVF&R reduces Newberg’s overall cost by over 40%. That cost will be shifted to taxpayers directly. The net result is that Newberg will have the same revenue for services other than Fire/EMS that it does now. And it can RAISE that revenue by 3% each year, above whatever other increases are allowed (Assessed Value increases, growth, etc.).

Does this mean I should vote against joining TVF&R?

NOT AT ALL! That is a separate decision for you to make and there is plenty of information available to help you with that decision. Our group is focused just on the tax issue. We hope that you’ll consider BOTH measures very carefully. They are both VERY important for the future of Newberg.

Does it matter how I vote on the Charter Amendment if I vote against TVF&R?

The Charter Amendment will not have any legal effect if Newberg doesn’t join TVF&R. Nevertheless, passing the Charter Amendment will send a clear signal to the City Council that you don’t approve of this method of raising taxes. Also, even if you vote against TVF&R, the majority of voters may vote otherwise. Won’t you want the Charter Amendment in place then?

Shouldn’t we be very cautious about amending the Charter?

YES, we should! If there were another way to restrict the City Council’s ability to collect these taxes, we’d likely be promoting it instead. The Council has discussed accomplishing the restriction through a Resolution or an Ordinance. The problem with those is that either could be rescinded by the Council at a single meeting. That’s not much of a limit on their authority!

What can I do to support this?

Tell your family, friends, neighbors, and co-workers about it. The biggest threat to is passage is that many don’t understand what it is all about. Education about it is the answer! Most importantly:

Vote YES on 36-191 (Newberg Charter Amendment)!!!

————————————————————————-

You should have your ballot now

I’ve been working on many aspects of this endeavor. The web site has been neglected in the process. Expect to see something new this weekend. Very shortly there should be something to see on Facebook for NewbergTaxes.org.

In any case, Vote Yes on 36-191!

(and tell your neighbors, friends, and co-workers about it)

The election is over!

We should be receiving ballots in a couple of weeks. Now is the time to be discussing the Charter amendment with family, friends, neighbors, and co-workers. Flyers are available for distribution for anyone who cares to do so. Click here to request some. Lawn signs will be available shortly. Click here to request one.

Important Update!

At its August 14 meeting, the Newberg City Council passed two Resolutions of interest. The first was to put the annexation of Newberg into the TVF&R district on the November, 2017 ballot. At least one Council member continues to portray this as “letting the citizens vote” as opposed to recognizing that they are simply following State law. Regardless, the end result is that the Council IS following the law and we will get to vote.

The second Resolution placed a Charter amendment on the same ballot. It is similar to what we have proposed, with one significant difference. While it does restrict the Council’s ability to collect the $1.88 (leaving them with $2.50/$1,000) for fiscal year 2018-2019, it allows them to increase the $2.50 by 3% each year if they so choose.

In the near future, our group will be discussing the level of support we choose to give to these two measures. Please feel free to email your views on this by clicking here.

Thanks to all who have assisted with this effort!

—————————————————————————————–

If you own a house with a taxable value of $250,000, Newberg collects about $1,095 in property tax every year. The City spends about $470 of this on a contract with Tualatin Valley Fire & Rescue (TVF&R) for Fire and EMS services. Before the TVF&R contract started in July, 2016, the City spent about $450 of your property tax on the Newberg Fire Department.

If the City of Newberg annexes into the TVF&R District, the District will collect about $520 in property taxes from you every year. This is a new tax that you are not presently paying. The City would no longer pay your $470 to TVF&R for its services as you would be paying TVF&R directly.

The City would NOT lose the authority to continue to collect the full $1,095 from you. If it continues to collect the full amount, it would result in an increase of about 47% for City + Fire/EMS property taxes. That is, the $1,095 that you are presently paying would increase to $1,615 ($1,095 to the City + $520 to TVF&R). If the City chose to reduce your tax by the $470 it no longer pays to TVF&R, your tax would be $1,145 ($625 to the City + $520 to TVF&R).

Each year, the City Council decides how much of the $1,095 it will collect from you as part of the budget process. It could choose to not levy any of the $470 it was spending on TVF&R one year and part or all of it the next.

What should be done about it? Expand A Charter Amendment should be placed on the ballot in 2018 that restricts the Council’s ability to levy more than $2.50/$1,000. This would effectively be the same as it presently collects when the Fire/EMS expense is removed. As a sign of good faith to its constituents, the City Council should take the initiative to place such an Amendment on the ballot. If not, it should be done by the citizens. Hide

What can I do now? Expand Talk to your Mayor and Council members. Contact information can be found at http://www.newbergoregon.gov/citycouncil . Click on any of the names for email addresses. Attend City Council meetings to voice your opinion during Public Comments, held near the beginning of the meeting. Meetings are generally held on the first and third Monday of each month at 7pm. Specific dates can be seen here: http://www.newbergoregon.gov/meetings . Be sure to fill out a Public Comment Form from: http://www.newbergoregon.gov/citycouncil/page/public-comment-registration-form or pick one up at the meeting. Keep watching this site for updates. We’ll try to let you know of upcoming events related to this issue. Contact the organizers (Robert Soppe rs@NewbergTaxes.org or Lon Wall lon@NewbergTaxes.org ) if you have questions or would like more information. Hide

Objections to the Charter Amendment Expand “It limits present and future City Councils with regard to property tax revenue.” This is correct, but the Council has already been limited by the Permanent Tax Rate Limit set by Measure 50 in 1997. This only removes the amount that the City has been paying for TVF&R’s contract once that contract is no longer in place and the City no longer funds Fire and EMS services. “This should be accomplished by some other method than a Charter Amendment, such as a Council Resolution.” A Charter Amendment is the only way to keep the authority of raising Newberg city property taxes in the hands of Newberg citizens. While a Council Resolution could apply the same tax limitation, it could easily be removed at a City Council meeting. “This will restrict the City from raising funds for needed projects such as roads.” The City Council would have the ability to raise revenue through the same methods that it now has such as a levy or fee. This adds another method where revenue could be raised by a change to the Charter Amendment. The Council could put a new Amendment on the ballot that lowers the $1.88 restriction to provide additional revenue. The Council would only need to convince a majority of voters that the increase is appropriate. “The cost of a ballot measure to revise the Charter Amendment could run as high as $50,000.” There are two “free” elections every other year. It is only in non-General Election years that there would be a cost to the City to put a measure on the ballot. The City should be able to plan its finances well enough that a Charter Amendment to increase property taxes (that is not at all allowed now) could be deferred for a year to avoid the election cost. Hide

Enter your email here to get on our mailing list.